NEWS

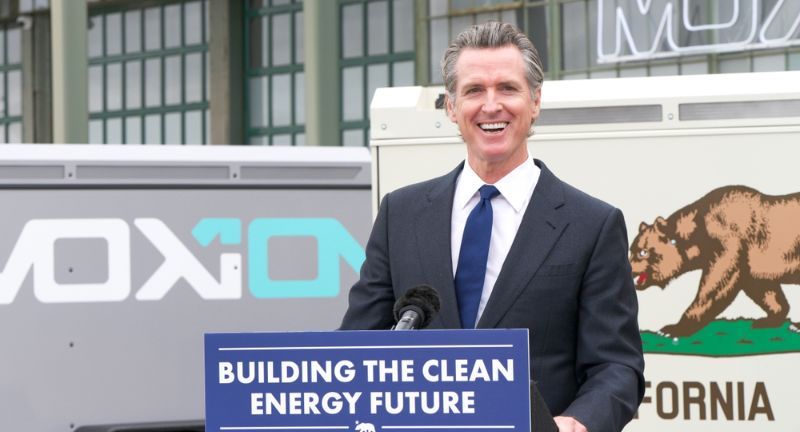

California Floating “Exit Tax” In 2024 To Stop Mass Wealth Exodus

Published

7 months agoon

Setting a Precedent

Eroding Tax Base

What Exactly Is The Tax?

Funding Public Services

Fair Contribution

Raising State Revenue

Negative Perception

Impact on Middle-Class Residents

Preventing Wealth Drain

Administrative Complexity

Legal and Constitutional Concerns

Alternative Solutions Overlooked

Discouraging Return

Conclusion

More From Local News X

-

Interview with Grandfather of Uvalde, TX Gunman, “I wasnt inside…

-

Quaker City String Band performs You’re A Grand Old Flag…

-

25 Most Common Travel Blunders People Make And How To…

-

MORE: Fire Erupts Near Griffith Observatory in Los Angeles, CA

-

People Evacuated from Boston Subway Due to Smoke

-

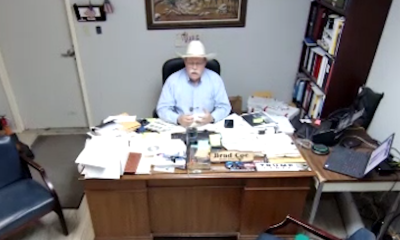

Schools need armed teachers and prayer, Kinney County, Texas sheriff…

-

Alex Murdaugh’s Lawyers Appeal Convictions, Alleging Jury Tampering

-

Truck on Fire on the Liberty Bridge

-

Humid, Foggy Weather Leads to Complications During Brooklyn Half Marathon,…

-

Demonstration at intersection after elder from Golden Gate Park Senior…

-

Large Boats Catches on Fire in English Harbor

-

Scene Videos from Robb Elementary School Shooting in Uvalde, Texas

25 Challenges Kids Are Facing Now That They Didn’t Face Back In The Day

Growing up today comes with unique challenges that previous generations never had to face. From the influence of technology and...

24 Facts About The Big Apple You Probably Didn’t Know

New York City, known as the Big Apple, is filled with fascinating history, hidden secrets, and unexpected quirks that even...

25 Shocking Discoveries Made In The Last 25 Years

The past 25 years have been a period of incredible discovery and innovation, with scientists uncovering shocking new insights about...

25 Most Common Travel Blunders People Make And How To Avoid Them

Traveling abroad is an exciting and enriching experience, but it can come with challenges if you’re not fully prepared. Many...