As technology evolves, scammers are finding new ways to target unsuspecting victims, making it essential to stay vigilant in 2025. From phishing emails to sophisticated online fraud, these scams can jeopardize your finances and personal information. However, with the right knowledge and precautions, you can protect yourself. Here are 21 ways to avoid getting scammed in 2025.

Beware of AI-Generated Voice Scams

Shutterstock

In 2025, scammers are using AI to mimic the voices of loved ones, making fraudulent calls seem genuine. If you receive an unexpected request for money or sensitive information, verify the caller’s identity independently. Call back using a known number to confirm their legitimacy. Staying cautious is key to outsmarting this advanced tactic.

Enable Two-Factor Authentication

Shutterstock

Two-factor authentication (2FA) adds an extra layer of security to your online accounts. By requiring a secondary code sent to your phone or email, it makes it harder for scammers to access your accounts, even if they have your password. Activate 2FA on all financial, email, and social media accounts. It’s a simple step that provides powerful protection.

Avoid Clicking on Unverified Links

Shutterstock

Scammers often use phishing emails or texts containing malicious links. These links can steal your personal information or install malware on your device. Always hover over a link to verify its source before clicking, and avoid interacting with unsolicited messages. Caution can save you from cyber traps.

Research Before Donating to Charities

Shutterstock

Charity scams continue to evolve, preying on goodwill after natural disasters or global events. Verify the legitimacy of a charity by checking reviews or visiting trusted platforms like Charity Navigator. Avoid donating via unsolicited calls or emails. Giving responsibly ensures your money goes to the right cause.

Use Secure Payment Methods

Shutterstock

Scammers often request wire transfers, prepaid cards, or cryptocurrency payments because they are hard to trace. Stick to secure payment methods like credit cards or payment apps with buyer protection. If a seller insists on untraceable methods, it’s a red flag. Protecting your payments protects your wallet.

Update Your Software Regularly

Shutterstock

Outdated software can leave your devices vulnerable to cyberattacks. Regular updates fix security vulnerabilities and improve defenses against scams. Enable automatic updates on all your devices to stay protected. A few clicks can prevent major headaches.

Be Wary of “Too Good to Be True” Offers

Shutterstock

Unbelievable discounts or offers often indicate a scam. Scammers lure victims with promises of free money, prizes, or high-value items at steep discounts. Research offers and sellers before making purchases. Trust your instincts—if it seems too good to be true, it probably is.

Set Strong and Unique Passwords

Shutterstock

Weak passwords make it easy for hackers to access your accounts. Use a mix of letters, numbers, and symbols, and avoid reusing passwords across platforms. Consider using a password manager to keep track of your credentials securely. A strong password is your first line of defense.

Educate Yourself About AI Scams

Shutterstock

Artificial intelligence is being used to create realistic fake videos, emails, and social media posts. Learn to spot inconsistencies, such as unnatural movements or grammar errors, in AI-generated content. Staying informed about new scam tactics helps you recognize and avoid them. Knowledge is a powerful defense.

Verify Online Reviews

Shutterstock

Fake reviews are becoming more common, making it difficult to trust ratings on websites. Cross-check reviews on multiple platforms to ensure authenticity. Look for balanced feedback rather than overly positive or negative comments. A little research goes a long way in avoiding scams.

Monitor Your Credit Reports Regularly

Shutterstock

Checking your credit report regularly helps you detect unauthorized activity or fraudulent accounts in your name. Use free resources like AnnualCreditReport.com or credit monitoring services to stay updated. Early detection of fraud allows you to take corrective actions quickly. Staying informed protects your financial health.

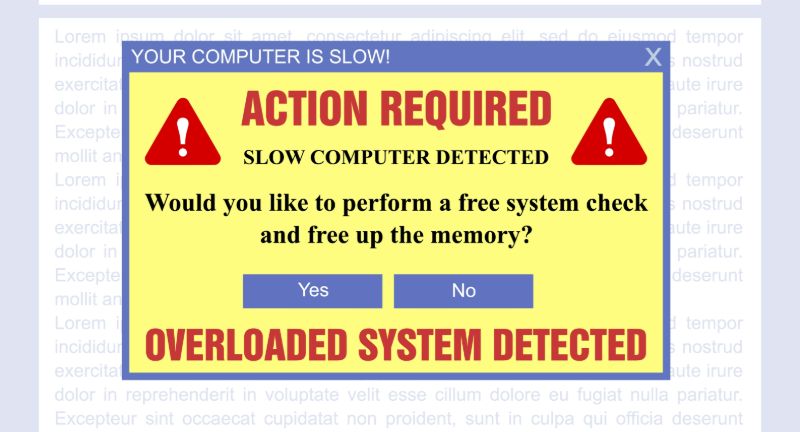

Be Skeptical of Urgent Requests

Shutterstock

Scammers often create a sense of urgency to pressure you into making quick decisions. Whether it’s a claim about unpaid taxes or a “limited-time” offer, take your time to verify the request. Genuine organizations will provide documentation and time to respond. Avoid making decisions under pressure to stay safe.

Use Secure Wi-Fi Networks

Shutterstock

Public Wi-Fi networks can expose your data to hackers. Avoid accessing sensitive accounts or making purchases on unsecured networks. Use a virtual private network (VPN) to encrypt your internet connection when using public Wi-Fi. Secure connections ensure your information stays private.

Shred Sensitive Documents

Shutterstock

Scammers can steal personal information from discarded documents like bank statements or credit card offers. Use a shredder to destroy any paperwork containing sensitive details before disposing of it. This simple step protects you from identity theft. Preventing unauthorized access starts with proper disposal.

Be Cautious with QR Codes

Shutterstock

Scammers are using fraudulent QR codes to direct users to malicious websites or steal payment information. Always verify the source before scanning a QR code, especially on public posters or emails. Use your device’s security tools to check the URL before proceeding. Caution prevents falling into digital traps.

Educate Family Members About Scams

Shutterstock

Scammers often target vulnerable groups, such as elderly relatives or teenagers. Sharing information about common scams and warning signs helps protect your loved ones. Encourage open discussions about suspicious messages or calls. Awareness is the first line of defense for everyone.

Limit Information Shared Online

Shutterstock

Oversharing personal details on social media or public forums can give scammers the information they need to target you. Avoid posting sensitive details like your full name, address, or travel plans. Adjust your privacy settings to limit what strangers can see. Protecting your digital footprint reduces scam risks.

Verify Seller Credibility

Shutterstock

Before making online purchases, research the seller to ensure their credibility. Check reviews, confirm their contact information, and look for secure payment methods. Avoid deals from unknown sellers on social media or shady websites. A little due diligence prevents costly mistakes.

Don’t Share OTPs or Passwords

Shutterstock

Scammers often impersonate trusted companies to request one-time passwords (OTPs) or login credentials. Legitimate organizations will never ask for these details. If you receive such a request, contact the company directly using official channels. Keeping this information private safeguards your accounts.

Recognize Emotional Manipulation

Shutterstock

Scammers often use emotional tactics, such as fake emergencies or promises of instant wealth, to manipulate their victims. Recognize when someone is trying to exploit your emotions and take a step back. Consult a trusted friend or professional before responding to such appeals. Staying level-headed protects you from impulsive decisions.

Secure Your Smart Devices

Shutterstock

Smart devices, like home assistants and IoT gadgets, can be vulnerable to hacking if not secured properly. Change default passwords, update firmware regularly, and enable security features like firewalls. Keeping these devices secure prevents unauthorized access to your personal information. A secure home is a safe home.

Conclusion

Shutterstock

Scammers are constantly evolving, but staying vigilant and informed can protect you from becoming a victim. By following these 21 strategies, you can safeguard your personal information, finances, and peace of mind in 2025. Remember, skepticism and caution are your best tools against fraud. Take proactive steps today to stay one step ahead of scammers.